Fed can cut rates, but won't yet as risk of fresh inflation 'too great:' Jefferies

EU and China set for talks on planned electric vehicle tariffs

Published 06/22/2024, 07:20 AM

Updated 06/22/2024, 01:06 PM

By Maria Martinez

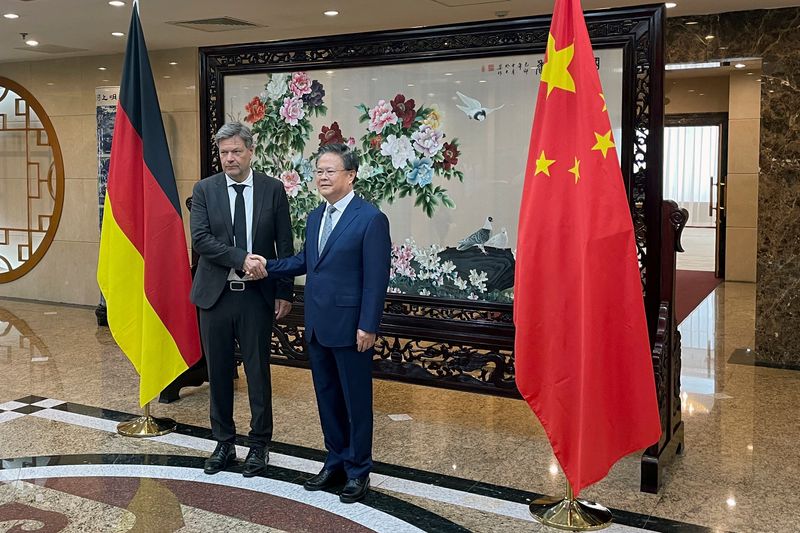

SHANGHAI (Reuters) -China and the European Union have agreed to start talks on the planned imposition of tariffs on Chinese-made electric vehicles (EVs) being imported into the European market, senior officials of both sides said on Saturday.

Germany's Economy Minister Robert Habeck said he had been informed by EU commissioner Valdis Dombrovskis that there would be concrete negotiations on tariffs with China.

The confirmation came after China's commerce ministry said its head Wang Wentao, and Dombrovskis, executive vice president of the European Commission, had agreed to start consultations over the EU's anti-subsidy investigation into Chinese EVs.

"This is new and surprising in that it has not been possible to enter into a concrete negotiation timetable in the last few weeks," Habeck said in Shanghai.

He said it was a first step and many more will be necessary. "We are far from the end, but at least, it is a first step that was not possible before."

The minister had said earlier on Saturday that the European Union's door was open for discussions regarding EU tariffs on Chinese exports.

"What I suggested to my Chinese partners today is that the doors are open for discussions and I hope that this message was heard," he said in his first statement in Shanghai, after meetings with Chinese officials in Beijing.

Habeck's visit is the first by a senior European official since Brussels proposed hefty duties on imports of Chinese-made electric vehicles (EVs) to combat what the EU considers excessive subsidies.

Habeck said there is time for a dialogue between the EU and China on tariff issues before the duties come into full effect in November and that he believes in open markets but that markets require a level playing field.

Proven subsidies that are intended to increase the export advantages of companies can't be accepted, the minister said.

Another point of tension between Beijing and Berlin is China's support for Russia in its war in Ukraine. Habeck noted Chinese trade with Russia increased more than 40% last year.

Habeck said he had told Chinese officials that this was taking a toll on their economic relationship. "Circumventions of the sanctions imposed on Russia are not acceptable," he said, adding that technical goods produced in Europe should not end up on the battlefield via other countries.

TIME FOR TALKS

The EU's provisional duties of up to 38.1% on imported Chinese EVs are set to apply by July 4, with the investigation set to continue until Nov. 2, when definitive duties, typically for five years, could be imposed.

"This opens a phase where negotiations are possible, discussions are important and dialogue is needed," Habeck said.

Proposed EU tariffs on Chinese goods are not a "punishment", Habeck told Chinese officials earlier in Beijing. "It is important to understand that these are not punitive tariffs," he said in the first plenary session of a climate and transformation dialogue.

Countries such as the U.S., Brazil and Turkey had used punitive tariffs, but not the EU, he said. "Europe does things differently."

Habeck said the European Commission had for nine months examined in detail whether Chinese companies had benefited unfairly from subsidies.

Any countervailing duty measure that results from the EU review "is not a punishment", he said, adding that such measures were meant to compensate for the advantages granted to Chinese companies by Beijing.

Zheng Shanjie, chairman of China's National Development and Reform Commission, responded: "We will do everything to protect Chinese companies."

Proposed EU duties on Chinese-made EVs would hurt both sides, Zheng added. He told Habeck he hoped Germany would demonstrate leadership within the EU and "do the correct thing".

He also denied accusations of unfair subsidies, saying the development of China's new energy industry was the result of comprehensive advantages in technology, market and industry supply chains, fostered in fierce competition.

The industry's growth "is the result of competition, rather than subsidies, let alone unfair competition," Zheng said during the meeting.

After his meeting with Zheng, Habeck spoke with Chinese Commerce Minister Wang Wentao, who said he would discuss the tariffs with EU Trade Commissioner Valdis Dombrovskis on Saturday evening in a video conference.

"There's room for manoeuvre, there's room for discussion and I hope that this room for manoeuvre will be taken," Habeck said.

In case the negotiations didn't reach a deal, Chinese carmaker SAIC Group has designed an array of creative products in response to the threat of tariffs.

Shao Jingfeng, chief design officer of the SAIC Motor R&D Innovation Headquarters, released pictures on his Weibo (NASDAQ:WB) social media account showing products such as skateboards, hoodies, sneakers, cups, umbrellas and table tennis paddles, mainly yellow and black in colour and emblazoned with the EU emblem and the figure "38.1" - a reference to the level of the EU's tariffs.

"What doesn't kill you makes you stronger," Shao wrote on Weibo. "Let us remember 38.1."

Latest comments

Next Article

EU tariffs on China not a 'punishment', says German economy minister

Published 06/21/2024, 11:16 PM

Updated 06/22/2024, 02:55 AM

BEIJING (Reuters) -Proposed European Union tariffs on Chinese goods are not a "punishment", Germany's Economy Minister Robert Habeck told Chinese officials in Beijing on Saturday.

Habeck's visit to China is the first by a senior European official since Brussels proposed hefty duties on imports of Chinese-made electric vehicles (EVs) to combat what the EU considers excessive subsidies.

China warned on Friday ahead of his arrival that escalating frictions with the EU over EVs could trigger a trade war.

"It is important to understand that these are not punitive tariffs," Habeck said in the first plenary session of a climate and transformation dialogue.

Countries such as the U.S., Brazil and Turkey had used punitive tariffs, but not the EU, the economy minister said. "Europe does things differently."

Habeck said that for nine months, the European Commission had examined in great detail whether Chinese companies had benefited unfairly from subsidies.

Any countervailing duty measure that results from the EU review "is not a punishment", he said, adding that such measures were meant to compensate for the advantages granted to Chinese companies by Beijing.

"Common, equal standards for market access should be achieved," Habeck said.

Meeting Zheng Shanjie, chairman of China's National Development and Reform Commission, Habeck said the proposed EU tariffs were intended to level the playing field with China.

Zheng responded: "We will do everything to protect Chinese companies."

Proposed EU import duties on Chinese-made EVs would hurt both sides, Zheng added. He told Habeck he hoped Germany would demonstrate leadership within the EU and "do the correct thing".

He also denied the accusations of unfair subsidies, saying the development of China's new energy industry was the result of comprehensive advantages in technology, market and industry chains, fostered in fierce competition.

The industry growth "is the result of competition, rather than subsidies, let alone unfair competition," Zheng said during the meeting.

The EU provisional duties are set to apply by July 4, with the investigation set to continue until Nov. 2, when definitive duties, typically for five years, could be imposed.

Habeck told Chinese officials the conclusions of the EU report should be discussed.

"It's important now to take the opportunity that the report provides seriously and to talk or negotiate," Habeck said.

After his meeting with Zheng, Habeck spoke with Chinese Commerce Minister Wang Wentao, who said he would discuss the tariffs with EU Commissioner Valdis Dombrovskis on Saturday evening via videoconference.

CLIMATE DIALOGUE

Although the trade tensions were a key topic to be discussed, the goal of the meeting was to deepen cooperation between both industrialised nations for the green transition.

This was the first plenary session of the climate and transformation dialogue after Germany and China signed a memorandum of understanding in June of last year for cooperation on climate change and the green transition.

The countries acknowledged they had a special responsibility to prevent global warming of 1.5 degrees Celsius (2.7 Fahrenheit) above pre-industrial temperatures, a level regarded by scientists as crucial to preventing the most severe consequences.

China installed almost 350 gigawatts (GW) of new renewable capacity in 2023, more than half the global total, and if the world's second-biggest economy maintains this pace it will likely exceed its 2030 target this year, a report published in June by the International Energy Agency (IEA) showed.

While Habeck praised the expansion of renewable energy in China, he noted that it is important not to look only at the expansion of renewables, but also the overall CO2 emissions.

Coal still accounted for nearly 60% of China's electricity supply in 2023. "China has a coal-based energy mix," Zheng said.

China, India and Indonesia, are responsible for almost 75% of the global total coal burned, as governments tend to prioritise energy security, availability and cost over the amount of carbon emissions.

Zheng said China was building coal-fired power plants as a security measure.

"I still believe that the enormous expansion of coal power can be done differently if one considers the implication of renewables in the system," Habeck replied.

Latest comments

Capitalism doesn't care about people, health, social contributions, enviroment. Only profits. Fair trade is much more than trade war games.

tell that to the Chinese dictatorship...

Same goes to the Chinese saying to EU. Is not an retaliation either.

Next Article

US imposes sanctions on Russia's AO Kaspersky Lab executives over cyber risks

Published 06/21/2024, 04:52 PM

Updated 06/21/2024, 07:00 PM

WASHINGTON (Reuters) -The Biden administration slapped sanctions on 12 people in senior leadership roles at AO Kaspersky Lab on Friday, citing cybersecurity risks a day after it announced plans to bar the sale of the Russian company's antivirus software.

The sanctions targeted leadership at the company, including the chief business development officer, chief operating officer, legal officer, corporate communications chief and others.

"Today's action against the leadership of Kaspersky Lab underscores our commitment to ensure the integrity of our cyber domain and to protect our citizens against malicious cyber threats," Treasury Under Secretary Brian Nelson said in a statement.

A Kaspersky spokesperson described the move as "unjustified and baseless," saying it would not affect the company's "resilience" since it does not target the parent or subsidiary companies or its chief executive, Eugene Kaspersky.

The company denied any ties to any government or any links between the designated officials and Russian military or intelligence authorities.

The moves show the Biden administration is trying to stamp out any risks of Russian cyberattacks stemming from Kaspersky software and keep squeezing Moscow as its war effort in Ukraine has regained momentum and the United States has run low on sanctions it can impose on Russia.

AO Kaspersky is one of two Russian units of Kaspersky Lab placed on a Commerce trade-restriction list on Thursday for allegedly cooperating with Russian military intelligence to support Moscow's cyber-intelligence goals.

That move was coupled on Thursday with an unprecedented ban on sales, resales and software updates for Kaspersky products in the United States starting Sept. 29.

U.S. authorities say the software poses serious risks, citing Russia's influence over the company, the software's privileged access to a computer's systems which could allow it to steal sensitive information from American computers, and its ability to install malware and withhold critical updates.

The designation announced Friday prohibits American companies or citizens from trading or conducting financial transactions with the sanctioned executives and freezes assets held in the United States.

Latest comments

Next Article

Stocks dip but up for the week, US dollar climbs

Published 06/20/2024, 10:34 PM

Updated 06/21/2024, 04:45 PM

By Chuck Mikolajczak and Isla Binnie

NEW YORK (Reuters) -A gauge of global stocks declined for a second straight session on Friday, weighed down by weakness in technology shares, while the dollar hit its highest level since early May as a gauge of U.S. business activity edged up to a more than two-year high.

S&P Global said its flash U.S. Composite PMI Output Index, which tracks the manufacturing and services sectors, inched up to 54.6 this month, the highest since April 2022, from a 54.5 reading in May. A reading above 50 indicates expansion.

However, while a rebound in employment helped lift the reading, price pressures eased, adding to recent data that has boosted optimism that inflation may be cooling.

On Wall Street, the S&P 500 and Nasdaq finished slightly lower as Nvidia (NASDAQ:NVDA) shares fell more than 3% as the biggest drag on both indexes and sending the tech sector lower.

Despite the decline, the chipmaker remains up about 155% on the year as an intense rally in AI-related stocks has lifted both indexes to multiple record highs in recent days.

"We've had a very strong run, especially in the S&P over the last couple weeks. So not surprised to see things kind of take a pause and settle down,” said Zachary Hill, head of portfolio management at Horizon Investments in Charlotte, North Carolina.

The Dow Industrials managed to eke out a small gain, in part driven by a climb in McDonald's (NYSE:MCD) shares. The Dow ended the week up 1.44%, its biggest weekly percentage gain since mid-May. The S&P rose 0.61% for its third straight weekly advance. The Nasdaq rose only 0.003% on the week, its third straight weekly advance.

The Dow Jones Industrial Average rose 15.57 points, or 0.04%, to 39,150.33, the S&P 500 lost 8.55 points, or 0.16%, to 5,464.62 and the Nasdaq Composite lost 32.23 points, or 0.18%, to 17,689.36.

MSCI's gauge of stocks across the globe fell 2.98 points, or 0.37%, to 801.37 after touching an intraday record of 807.17 on Thursday but was still on track for a third straight week of gains.

Other economic data on the housing market showed U.S. existing home sales fell for a third straight month in May as record-high prices and a resurgence in mortgage rates kept potential buyers on the sidelines.

European stocks closed lower, pressured by falls in bank stocks and technology shares against a backdrop of economic data showing euro zone business growth slowed sharply this month.

The STOXX 600 index fell 0.73%, while Europe's broad FTSEurofirst 300 fell 15.59 points, or 0.76%.

U.S. Treasury yields briefly inched higher after the data but were largely little changed on the session, with the yield on benchmark U.S. 10-year notes 0.1 basis point higher at 4.255%. The 10-year yield was set for its first weekly climb after two straight declines.

The dollar index, which measures the greenback against a basket of major currencies, gained 0.17% to 105.81, with the euro down 0.09% at $1.069.

Sterling slightly weakened 0.05% to $1.2649.

Against the Japanese yen, the dollar strengthened 0.43% to 159.59. That level had not been seen since late April when Japanese authorities intervened to halt the rapid fall in the currency.

Japanese data earlier on Friday indicated the country's demand-led inflation slowed in May, clouding the picture for a rate hike from the Bank of Japan.

Bank of Japan Deputy Governor Shinichi Uchida said on Friday the central bank was willing to raise rates if the economy and prices move in line with its forecasts, but signs of weakness remained.

In commodities, the stronger dollar helped send oil prices lower, with U.S. crude settling down 0.69% at $80.73 a barrel and Brent off 0.55% on the day to settle at $85.24 per barrel. Both crude benchmarks finished up about 3% on the week, however.

Latest comments

''but they are getting a little bit expensive'' - as little as just 155%...

Next Article

Investing.com -- U.S. interest rates remain at the highest level in decades and many are calling on the Federal Reserve to cut rates to ensure that the path to a soft landing remain intact, but while central bank could justify a cut, the risk of pre-emptive rate cuts fueling a re-acceleration is "too great.'

"The Fed can cut rates but doesn't have to... yet," Jefferies said in a Friday note, pointing to underlying strength in the economy suggesting that no accommodation from the Fed is needed. "The risk of restoking the flames of inflation are too great to warrant pre-emptive rate cuts," it added.

The resilience in the U.S. economy has caught by many surprise, Jefferies admits as it ditched its recession call after pushing it back several times. But while there are signs of slowing growth, Jefferies doesn't believe that the risks of an outright recession have risen materially, though persists with its call for one cut this year either in November or December.

The call for one cut matches that of the Fed's. During the June FOMC meeting, voting Fed members cut their outlook for rate cuts from three this year to just one amid expectations for inflation to remain higher than previously expected.

But market consensus is currently looking for a cut as soon as September, with the odds at about 61%, according to Investing.com's Fed Rate Monitor Tool.

Beyond 2024, however, there is hope for steeper cuts as the Fed's fight against inflation could get a helping hand from improved productivity, Jefferies says, at a time when labor turnover is easing, suggesting that workers aren't as willing to switch jobs for higher pay as they may have been in the past.

If the inflation relief coming from higher productivity manifests, Jefferies estimates that "there could be more room for a few more cuts late in 2025 or in 2026."

Latest comments

Next Article

No comments:

Post a Comment